Preparing for Basic Settings

To prepare for basic settings, user need to:

- Use the 5-minute Japanese candlestick chart. Choose from the following assets: EUR/USD, USD/JPY, AUD/USD

- Choose an expiration time of 15 minutes or more

Morning Star Pattern

A morning star pattern is made up of three candles:

- The first candlestick is red and has a long body, indicating that the price is falling

- The second candlestick can be either a doji or spinning top candlestick

- The third candlestick is green and must be at least half the length of the first candlestick

Between two big red and green candles, there are also special candles called Doji and Spinning Top. They show that the prices stopped dropping at a certain level and are getting ready to go up.

Opening Deals Formula

The UP formula is used to identify opening deals. It involves two key elements: prices falling into the support zone and the appearance of a Morning Star candlestick pattern. The Morning Star pattern is created when the price falls into the support zone with a strong bearish candle. The second candle, a Spinning Top or Doji, shows the price's reaction to the support zone. Finally, the third candle indicates that the price will rise again.

Capital Management Method

For this trading strategy, it is best to use the Classic capital management method. This method involves opening deals with a constant amount of money. The Morning Star candlestick pattern is highly accurate, but it rarely appears on the price chart. Therefore, the Classic capital management method is the most reasonable option.

Notes

- Open deals when the third candlestick of the pattern closes and the price shows signs of creating a Morning Star candlestick pattern

- After opening a deal, turn off computer to avoid psychological impact while waiting for the deal to close

- Do not open too many consecutive deals, even if opened them correctly but still lost. Just consider that the strategy didn't provide additional income. Stay calm and wait for the next opportunity

Tips for Opening Deals in Binomo

Deal 1:

- Look for a strong bearish trend

- Wait for the price to strongly touch the support zone

- Look for a Morning Star candlestick pattern

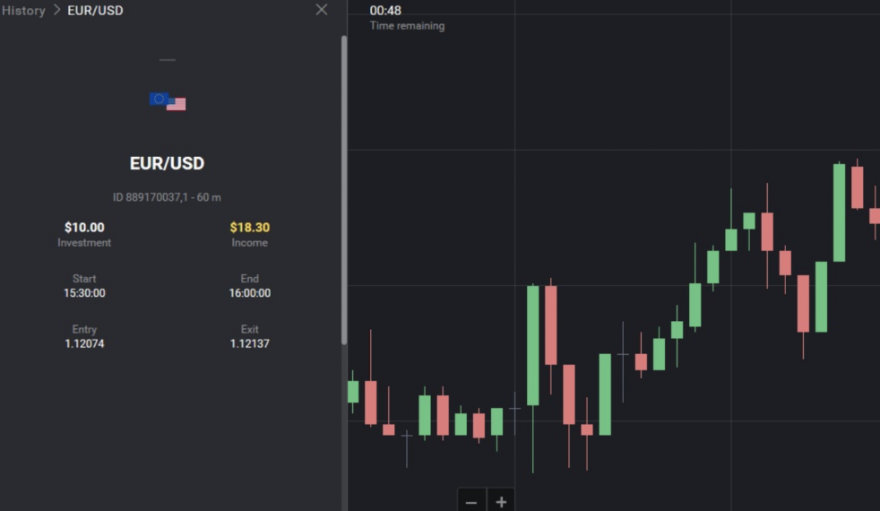

- Open UP deals with the expiration time of 30 minutes (opening deal at 15:30 and ending at 16:00)

Result:

Deal 2:

The price rises above the resistance zone, tests it again with the Morning Star candlestick pattern, and enters the support zone. This strategy involves opening a deal at 14:20 and closing it at 14:45 for a 25-minute expiration time

Result:

The Morning Star candlestick pattern is a simple strategy used by many Binomo traders. Any user can try it out on a demo account to get familiar with it.